How To Be A Winner On A Very Large Scale

The Incredible Benefits Of Selective Attention

How To Be A Winner

This is not a typical article about how to be a winner.

We are not going to talk about goal setting, the importance of habits, the power of focus and all the other usual practical pointers to winning in life.

This article is about how to be a winner on a very large scale.

Those of us who are employed operate in an environment that is transaction based. You have a product, a service or skillset to sell and someone or some organisation is a buyer of that product or service. You sell your expertise to your employer you may sell to your customers.

You are an investor

You are also an investor. You invest your time and resources in what you do and how you do it. You invest in your professional and personal development. You may also make financial investments in shares and assets.

The generic principles of winning on a large scale

I am a business man so inevitably my focus is on the world of business, but whilst the principles that I am going to share with you here are derived from the world of investment and business they have a wider application in many different contexts.

These are not only principles but I will also share practical action points on how to be a winner on a large scale.

First, we are going to look at some of the principles outlined by Charlie Munger [Warren Buffet's partner at investment behemoth Berkshire Hathaway] in his famous talk at USC Business School in 1994 entitled "A Lesson on Elementary Worldly Wisdom".

In this talk Munger outlines some of his thoughts on how to think effectively and the importance of using mental models, and then follows this up with some practical advice on how to make good investments.

Then I want to develop the 3 key ideas I shared with you in "The Metagame Approach To Life" which is about the game beyond the game. This is not about competing with others but is about competing with yourself to become the best version of you rather than a good version of other people.

Reflection

There may be some readers who will wonder at the motivation of anyone wanting to learn how to win on a largescale, and there maybe others who will question the perceived greed of wealthy old men accumulating vast quantities of wealth for themselves and their very rich shareholders.

Here is what Warren Buffett said about his shareholders in his 2022 newsletter:

"Though these people live well, they eventually dispense most of their funds to philanthropic organizations. These, in turn, redistribute the funds by expenditures intended to improve the lives of a great many people who are unrelated to the original benefactor.

Sometimes, the results have been spectacular.

The disposition of money unmasks humans.

Charlie and I watch with pleasure the vast flow of Berkshire-generated funds to public needs..."

Munger On How To Be A Winner On A Very Large Scale

Anyone studying the many interviews and articles featuring Charlie Munger and Warren Buffett will be struck by the simplicity and commonsense of their ideas. This can make them easy to dismiss and to assume that in reality they have some secret sauce that helps them pick their investment winners.

The truth is far simpler. They actually do what they say they do, and do it very well. This is what I often refer to as uncommon sense.

The Buffett/Munger approach to how to be a winner is contrarian, counter-intuitive, deeply rational and extremely effective.

In summary, Warren Buffett and Charlie Monger are the living embodiment of the incredible benefits of selective attention.

The ideas that follow really do work. I have proven them time and again in my own business career and have observed many other fail by ignoring them.

[1] You Can't Know Everything About Everything All The Time

And yet, according to Munger, in the world of investment management, practically nobody operates that way:

" A huge majority of people have some other crazy construct in their heads. And instead of waiting for a near cinch and loading up, they apparently ascribe to the theory that if they work a little harder or hire more business school students, they’ll come to know everything about everything all the time.

To me, that’s totally insane. The way to win is to work, work, work, work and hope to have a few insights."

[2] Stay In Your Circle Of Competence - Stick To What You Know

We all have a circle of competence. But it's hard to step outside of that circle.

If you do, you will be competing with other people with a lot more experience and expertise than you have and you will lose.

You’ve got to play within your own circle of competence and you've got to figure out where you've got an edge.

"If you want to be the best tennis player in the world, you may start out trying and soon find out that it’s hopeless—that other people blow right by you. However, if you want to become the best plumbing contractor in Bemidji, that is probably doable by two-thirds of you.

It takes a will. It takes intelligence. But after a while, you’d gradually know all about the plumbing business in Bemidji and master the art. That is an attainable objective, given enough discipline.

And people who could never win a chess tournament or stand in center court in a respectable tennis tournament can rise quite high in life by slowly developing a circle of competence—which results partly from what they were born with and partly from what they slowly develop through work."

Comment:

These first 2 points about sticking to what you know seem so blindingly obvious you would assume that everyone that knows this does this.

They may know, but they don't do it.

In the world of commodities, which is my area of work, I have been amazed at the number of people who try and set themselves up in business as brokers and go round in circles chasing deals in different markets about which they have limited if any real knowledge or experience.

In business I have seen a number of friends trying [and failing] to launch and run businesses in areas about which they know little to nothing and for they are totally ill-equipped to handle. Needless to say they fail.

I did counsel a couple of them to get back to basics and focus on their core competencies - which they did with some success.

[3] Work Hard To Find The Few Insights And Then Really Go For Them

How many insights do you need?

"Well, I’d argue: that you don’t need many in a lifetime.

If you look at Berkshire Hathaway and all of its accumulated billions, the top ten insights account for most of it. And that’s with a very brilliant man [Warren Buffett] devoting his lifetime to it. I don’t mean to say that he’s only had ten insights. I’m just saying, that most of the money came from ten insights."

There are countless potential opportunities, but very, very few where the odds are in your favour, so narrow your focus and sharpen it to find those few.

Munger makes the point that: "...you’re probably not going to be smart enough to find thousands in a lifetime. And when you get a few, you really load up. It’s just that simple."

This is the fundamental key to Munger and Buffett's phenomenal success.

When Warren Buffett lectures at business schools, he says:

“I could improve your ultimate financial welfare by giving you a ticket with only 20 slots in it so that you had 20 punches—representing all the investments that you got to make in a lifetime. And once you’d punched through the card, you couldn’t make any more investments at all.”

He says:

“Under those rules, you’d really think carefully about what you did and you’d be forced to load up on what you’d really thought about. So you’d do so much better.”

Resources:

[1] Factors that will work against you:

- Herd Mentality - How to avoid it and stay far from the madding crowd

- Fear Of Missing Out - We follow the herd - and often without realizing it - we mimic other people's choices.

- Group Culture and Group Think - The invisible software that rules your life

- Cognitive Misjudgments - The psychology of human misjudgment

[2] Extensive resources and actions for finding the key few insights:

- How Positive Asymmetry Can Transform Your Life - Finding this hidden value is the key to a huge upside.

- The Metagame Approach To Life - How to achieve your biggest objectives.

Munger On How To Invest

Munger and Buffett take the view that the traditional approach to stock picking is a waste of time and doomed to fail. Their rationale [and they provide a lot of evidence to support this] is that it is not possible to consistently out perform the market this way.

Their whole investment strategy is based on looking for the very occasional winner and then investing very heavily.

In my view, and based on my experience, this very selective and highly targeted approach applies in other areas of business and life.

In my world of commodities and specifically the fuel market, I see brokers and some traders continually looking at new offers and new potential sources of supply. I used to get a dozen or more such offers every week. This is caused partly by a combination of any or all of the following factors:

- Herd instinct

- Fear of missing out

- Cognitive biases and misjudgements

- Do something syndrome

- Mud on the wall syndrome

- Addiction to the deal process

I think it is insane, but this behaviour is very, very common and these factors are what drive the standard investment behaviour that Munger speaks out against.

My approach is to take the long view and to do all the things I am discussing in this article to find one seller, may be two sellers, I can build deep and long standing relationships with, and to work with a very small number of buyers who I know and understand very deeply as well, and to sustain these working relationships for a number of very profitable years.

That said here are 3 tips from Munger on how to invest:

[1] Invest very selectively

"To me, it’s obvious that the winner has to invest very selectively. It’s been obvious to me since very early in life. I don’t know why it’s not obvious to very many other people.

There are huge advantages for an individual to get into a position where you make a few great investments and just sit back and wait.

And you may find one or two or three in a long lifetime that are very good. And you may find 20 or 30 that are good enough to be quite useful."

[2] Invest very seldom

How to be a winner instead of a loser?

The one thing that all winning investors have is quite simple. They invest very seldom.

"It’s not given to human beings to have such talent that they can just know everything about everything all the time.

But it is given to human beings who work hard at it who look and sift the world for an opportunity with huge upside that they can occasionally find one.

And the wise ones invest heavily when the world offers them that opportunity. They invest big when they have the odds. And the rest of the time, they don’t. It’s just that simple."

[3] Pick your market timing

Markets are manic depressive

Munger understands market over reaction and suggests to time your buying or selling of a stock to align with the most favourable conditions for your transaction.

He and Buffett were initially heavily influenced by investment guru Ben Graham, author of "The Intelligent Investor" who created his concept of “Mr. Market”.

Graham did not see the market as efficient, he saw it as a manic-depressive.

And some days "Mr Market" says, “I’ll sell you some of my interest for way less than you think it’s worth.”

And other days, “Mr. Market” comes by and says, “I’ll buy your interest at a price that’s way higher than you think it’s worth.” And you get the option of deciding whether you want to buy more, sell part of what you already have or do nothing at all.

Munger says:

"To Graham, it was a blessing to be in business with a manic-depressive who gave you this series of options all the time. That was a very significant mental construct. And it’s been very useful to Warren Buffett, for instance, over his whole adult lifetime."

Munger's advice is drawn from the world of investment and stock picking. I now want to build on that and share some further insights from the world of sales and trading. These are things that I have done and continue to do, and form the foundation of my current approach to business. The metagame approach to life is all about how to be a winner on a large scale, and it involves: The metagame approach to life also has an important transcendent dimension in that it will enable you to become

the best version of yourself.

In the metagame

I shared 3 of my strategies for applying the metagame approach to life, namely: [1] Play The Long Game The long game is an approach to any area of life that sacrifices short term gains for long-term wins, and it requires that you are prepared to make a lot of mistakes and errors and are prepared to look an idiot in the short term to look like a superstar and make massive gains in the long term. [2] Exploit The Hidden Margins This is about identitying and benefiting from unrecognised opportunites for significant potential gain. Often these

less visible opportunities have massive upside. The key is knowing what to look for and how to exploit it. [3] Focus On The Fat Tail Fractal Factor This is about: adopting a very targeted approach by hunting with a rifle not a shotgun; being the best at what you do; focusing your efforts on quality not quantity. If you can master the dynamics of each of these 3 strategies you will know how to be a winner on a very large scale in any area of life that really matters to you. But it doesn't end there! These 3 strategies are all about what you have to do. The enhanced metagame takes account of your counter party's position. If you understand this you can refine your use of each of these strategies to achieve great leverage in your outcomes for a few very small adjustments to your efforts. Understanding your counter-party's position Just to be clear, your counter party is the other person or party to the interaction or transaction you are engaged in. [1] Long Game / Short Game You are playing the long game but in many cases your counterparty will be playing a short game. This

will be highly likely if the context of your transaction is business

and/or if your counterparty is in a senior role in operations or sales. These people will be usually be under big pressure to perform with monthly and quarterly performance targets to hit. They will also be facing exposures in the form of personal accountability that can affect their remuneration and their position in the event of failure to hit their targets. From your perspective, two important aspects of playing the long game are being prepared and being patient because this creates the environment where the counter-party wants to buy. [2] Hidden Margins / The Judo Effect Judo is a martial art which focuses on defeating your opponent by using their force and momentum against them. Let's see how this applies to the enhanced metagame approach. You are focused on intangible margins such as:

perceptions and expectations, feelings and experiences, slack and space. You are also focused on secondary currency such as:

reputation, trust, respect, influence, peace of mind

and the transfer of skills, knowledge and information. You have this focus because you know that this is what unlocks the primary currency of tangible benefits and especially money. In contrast your counter party is playing a short game and his/her focus will be on all the tangible metrics of the transaction - largely to do with money and performance. The less experienced player will immediately engage with the counter-party on these tangible metrics and get drawn into negotiations too soon. You don't ignore these tangible factors you address them, but your focus remains on the bigger picture and the intangible and secondary currency factors. This is disarming and attractive

to your counterparty, because your wider focus addresses personal [in addition to organisational] needs. To some extent this almost subliminal. The judo effect kicks in as your counterparty is increasingly motivated to do business with you because of his short game pressures to do so quickly and because he senses that you are looking after his personal needs and requirements. Fat Tail Fractal Factor / The Best Fit Outcome You are focused on the top 1% of your prospects and potential opportunities that will deliver the largest proportion [in some cases all] of your desired outcome. By adopting this highly targeted approach, in the context of the long game and with a strong focus on the intangible and secondary currency aspects you are elevating yourself to a rarified atmosphere where you have little to no competition and you are now largely only competing with yourself.

You have transcended your competition. Your counter party will also know this. Your extensive and intensive preparations will mean that you are providing him/her with the best fit solution. Your counter party will buy from you. The Enhanced Metagame - The Lollapalooza Effect The combined effect of enacting these 3 strategies and taking full account of your counterparty's position leads to what Charlie Munger refers to as the lollapalooza effect [technically this is known as autocatalysis]. The lollapalooza

effect occurs when two or more forces are all operating in the same

direction and often you

don’t get just simple addition but rather you get a nuclear explosion

once you reach a certain point of interaction between those forces such

as a breakpoint or critical-mass is reached. This is how to be a winner on a large scale. Further Reading Understanding Complex Systems Thinking - It's Not Complicated The Metagame Approach To Life - How To Achieve Your Biggest Objectives How Positive Asymmetry Can Transform Your Life Why Understanding Ergodicity Is Critical To Your Long Term Survival Finding Signal In The Noise - How To Avoid The Noise Bottleneck Growth Mindset - How To Be There When Preparation Meets Opportunity The Art Of Thinking Clearly - How To Do More Than Just Survive And Reproduce The Qualities Of Finite And Infinite Games Return from: "How To Be A Winner" to: Walking The TalkHow To Be A Winner With The Enhanced Metagame

LATEST ARTICLES

Master The Season You Are In - The Key to Fulfilling Your Purpose

To fulfil your purpose, you must first master the season you are in. One of the biggest mistakes you can make in life is focusing all your energy on the next season instead of learning to master the s…

To fulfil your purpose, you must first master the season you are in. One of the biggest mistakes you can make in life is focusing all your energy on the next season instead of learning to master the s…The Inner Weight of Shame - Sustained By Attentional Fixation

A Mind That Is Continuously Engaged In Self-Surveillance. Shame is one of the heaviest inner burdens a human being can carry. It does not announce itself loudly or demand attention through drama. Inst…

A Mind That Is Continuously Engaged In Self-Surveillance. Shame is one of the heaviest inner burdens a human being can carry. It does not announce itself loudly or demand attention through drama. Inst…Does Prayer Work? The Psychology of Prayer, Meditation and Outcomes

Reality Is A Complex System Of Countless Interactions - Including Yours. So does prayer work? The problem is that the question itself is usually framed in a way that guarantees confusion. We tend to a…

Reality Is A Complex System Of Countless Interactions - Including Yours. So does prayer work? The problem is that the question itself is usually framed in a way that guarantees confusion. We tend to a…Living in Survival Mode Without Surrendering Mental Authority

Living in Survival Mode Without Surrendering Mental Authority

Clear Thinking When You’re Just Trying to Stay Afloat. Many people today are overwhelmed because they are living in survival mode - not temporarily, but as a persistent condition of life. For many, th…

Clear Thinking When You’re Just Trying to Stay Afloat. Many people today are overwhelmed because they are living in survival mode - not temporarily, but as a persistent condition of life. For many, th…Manifestation Without Magic: A Practical Model

Manifestation without magic is not a softer or more intellectual version of popular manifestation culture. It is a different model altogether. Popular manifestation teachings tend to frame reality as…

Manifestation without magic is not a softer or more intellectual version of popular manifestation culture. It is a different model altogether. Popular manifestation teachings tend to frame reality as…Staying Committed When You Can't See Progress - The Psychology of Grit

Uncertainty Is Not The Absence Of Progress, Only The Absence Of Reassurance. One of the most destabilising experiences in modern life is not failure, but uncertainty and staying committed when you can…

Uncertainty Is Not The Absence Of Progress, Only The Absence Of Reassurance. One of the most destabilising experiences in modern life is not failure, but uncertainty and staying committed when you can…The Battle For Your Mind - How To Win Inner Freedom In A Digital Age Of Distraction

From External Events to Inner Events. We often think of “events” as things that happen out there: the traffic jam, the rude comment, the delayed email reply. But what truly shapes our experience is wh…

From External Events to Inner Events. We often think of “events” as things that happen out there: the traffic jam, the rude comment, the delayed email reply. But what truly shapes our experience is wh…How to See Your Thoughts Without Becoming the Story

A Practical Guide to Thought-Awareness. You can spend your life inside the stories of your mind without ever learning how to see your thoughts clearly and objectively. Most of the stuff we tell oursel…

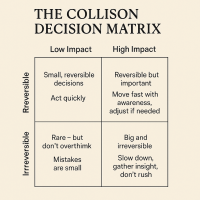

A Practical Guide to Thought-Awareness. You can spend your life inside the stories of your mind without ever learning how to see your thoughts clearly and objectively. Most of the stuff we tell oursel…The Collison Decision Matrix - A Simple Framework for Better Choices

The Collison Decision Matrix Is A Practical Everyday Thinking Tool. Most of us spend a surprising amount of time worrying about decisions. From small ones such as what to wear, what to eat, what to te…

The Collison Decision Matrix Is A Practical Everyday Thinking Tool. Most of us spend a surprising amount of time worrying about decisions. From small ones such as what to wear, what to eat, what to te…The Power Of Asking The Right Question

The Power Of Asking The Right Question Lies In The Quest For Insight. To experience the power of asking the right question you must develop the practice of asking questions. The best way to improve th…

The Power Of Asking The Right Question Lies In The Quest For Insight. To experience the power of asking the right question you must develop the practice of asking questions. The best way to improve th…Site Pathways

Here is a site pathway to help new readers of Zen-Tools navigate the material on this site. Each pathway is based around one of the many key themes covered on this site and contain a 150 word introduc…

Here is a site pathway to help new readers of Zen-Tools navigate the material on this site. Each pathway is based around one of the many key themes covered on this site and contain a 150 word introduc…